|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

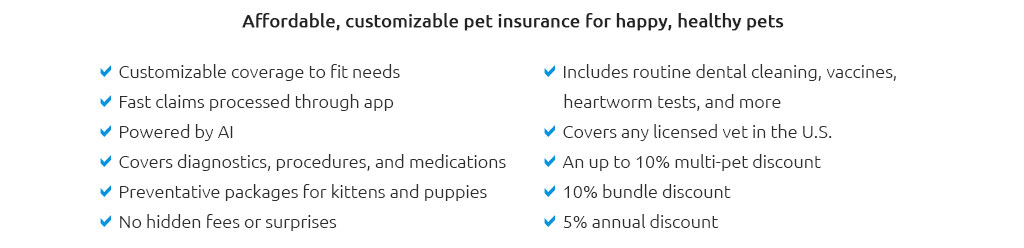

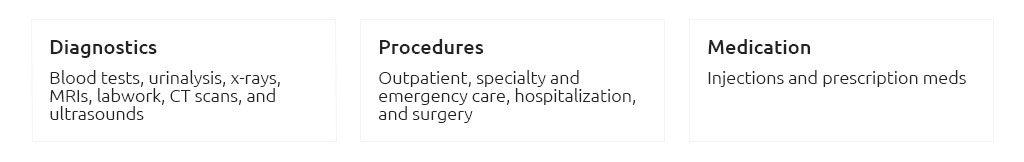

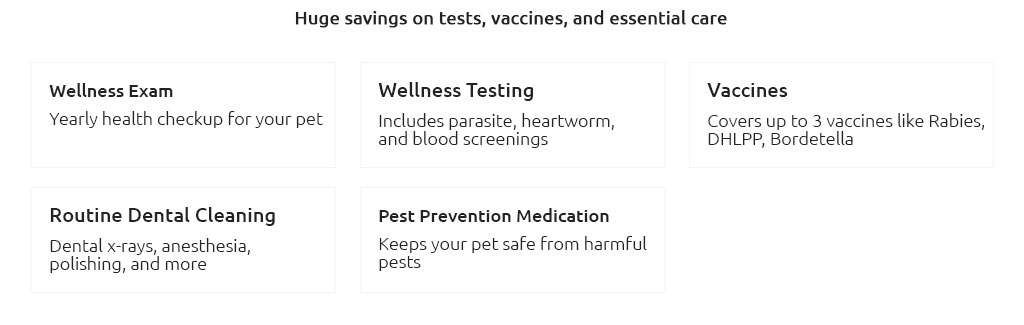

Understanding Pet Health Insurance in Columbus, Ohio: A Comprehensive GuideLiving in Columbus, Ohio, pet owners are increasingly considering the benefits of pet health insurance, a topic that has gained significant attention as people become more invested in their pets' well-being. With veterinary costs rising and pets becoming integral members of the family, the question of whether or not to purchase pet insurance has become a pertinent one. One of the primary advantages of pet health insurance is the peace of mind it provides. Knowing that unexpected veterinary bills will not disrupt your finances can alleviate a significant amount of stress. Many pet owners in Columbus have started to see the value in insuring their pets, similar to how they would protect other valuable assets. Pet insurance policies typically cover a range of services, from routine check-ups to emergency surgeries, making them a versatile option for pet care. When considering pet insurance in Columbus, it is essential to evaluate the different types of coverage available. Most companies offer basic accident coverage, but more comprehensive plans include illness and wellness coverage, which can be beneficial if your pet requires regular medical attention. Additionally, some insurers provide options for dental care, alternative therapies, and even behavioral treatments, which can be particularly advantageous for pets with specific needs. Choosing the right policy involves carefully assessing your pet's health needs, your budget, and the level of coverage you desire. Columbus offers a plethora of choices, with several providers competing to offer the best plans. It's wise to compare the premiums, deductibles, and reimbursement rates, as these can vary significantly between companies. Reading reviews and seeking recommendations from local veterinarians can also provide valuable insights into which providers are most reliable and customer-focused. Factors to Consider When Selecting Pet Insurance

Ultimately, the decision to invest in pet health insurance should be based on a thorough understanding of your pet's health needs and your financial situation. While some may argue that setting aside savings for pet emergencies is sufficient, insurance provides a structured approach to managing potential high costs, offering coverage for a wide range of scenarios that savings might not fully cover. FAQs About Pet Health Insurance in Columbus, Ohio What types of pet insurance plans are available in Columbus? Most insurers offer accident-only, accident and illness, and comprehensive plans that include wellness coverage. How do I know if a pet insurance policy is suitable for my pet? Evaluate your pet's health history, breed-specific risks, and compare the coverage options, premiums, and deductibles of different policies. Are pre-existing conditions covered by pet insurance in Columbus? Typically, pre-existing conditions are not covered, so it's beneficial to enroll your pet in a plan while they are young and healthy. What should I look for in a pet insurance provider? Consider the provider's reputation, customer reviews, the claim process, and customer service quality to ensure a positive experience. https://www.lemonade.com/pet/explained/ohio-pet-insurance-guide/

As of 2025, the average estimated cost of Lemonade pet insurance in Ohio ranges from roughly $30 to $34 a month, depending on factors like your pet's breed ... https://www.healthypawspetinsurance.com/locations/oh/ohio-pet-insurance

Everything we do is driven from our love of animals and our commitment to pet health. We offer one pet insurance plan that covers vet visits for new accidents ... https://www.hondainsurancesolutions.com/s/pet-insurance-honda

Pet insurance 1 is available for dogs, cats, birds, and exotic pets 2. Pet insurance coverages. Accidents + Injuries; Common Illnesses ...

|